Bank of America reported strong first-quarter results on Tuesday, beating or meeting Wall Street expectations on almost every single metric, while the bank's leader cheered improving economic optimism in the country.

Bank of America's stock rose as much as about 1.5 percent in the premarket but then lost its gains after Goldman Sachs reported disappointing earnings.

Here's Bank of America's report card for the quarter:

- EPS: 41 cents versus 35 cents expected by Thomson Reuters analysts' consensus

- Revenue: $22.2 billion versus $21.611 billion expected by Thomson Reuters analysts' consensus

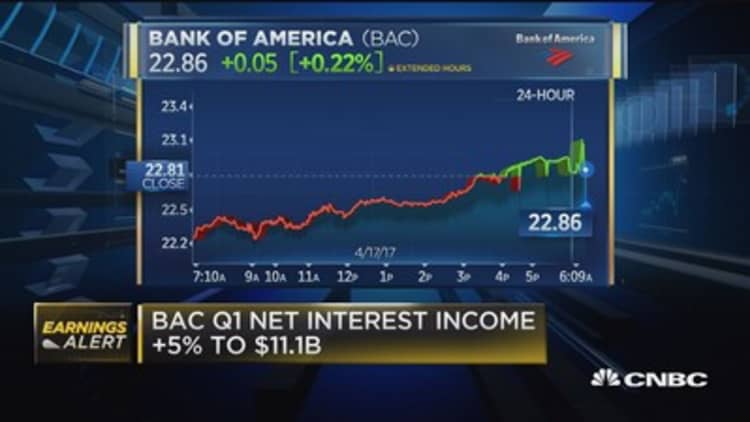

- Net interest income: $11.1 billion versus $11.1 billion expected by StreetAccount analysts' consensus

- Fixed income trading revenue: $2.9 billion versus $2.62 billion expected by StreetAccount analysts' consensus

- Net charge-offs: $934 million versus $964.2 million expected by StreetAccount analysts' consensus

The bank also said its loans business grew by 6 percent in the first quarter.

"Our approach to responsible growth delivered strong results again this quarter," CEO Brian Moynihan said in a statement.

"Consumer spending was up, our wealth management business had strong asset management flows, investment banking fees rebounded nicely, and we continued to provide credit and capital to our corporate and institutional clients to help them drive the economy forward," he said.

Sales from the company's trading business totaled $3.9 billion last quarter, boosted heavily by a 29 percent spike in fixed-income trading and a 7 percent jump in equities.

Net charge-offs, a measure of costs for bad debt, declined 13 percent to $934 million.

The banking giant's stock has been on a tear over the past year, rising more than 60 percent during that time period. However, Bank of America's stock is up just 3 percent in 2017 and has fallen more than 9 percent over the past month.

BAC over past year

Source: FactSet

Two factors that helped lift Bank of America's stock over the past year were the prospects of higher interest rates in the U.S. and deregulation coming from the White House.

The Federal Reserve raised interest rates in March and December, but U.S. Treasury yields have recently declined as the so-called hard data points have slipped.

On Friday, the Labor Department said the consumer prices index — a key gauge of inflation — posted its biggest drop in more than two years in March, while the Commerce Department said retail sales dropped more than expected last month. In turn, market expectations for a Fed rate hike in June have slipped.

Meanwhile, investors have also grown skeptical about where the White House's priorities lie. The stock market rallied after President Donald Trump's victory on the prospects of deregulation, tax reform and government spending.

Trump said last week his administration was reducing regulations and may eliminate and replace the Dodd-Frank Wall Street reform law, which was enacted in a bid to avoid the abuses that led to the Great Recession.

"We're going to reduce taxes, we're going to eliminate wasteful regulations," Trump said at a meeting attended by corporate leaders and members of his Cabinet.

But Trump has spent much of his energy dealing with foreign affairs as tensions between the U.S. and North Korea increased last week.

—Reuters contributed to this report.

Correction: This story has been updated to reflect that Bank of America's net charge-offs totaled $934 million.