American farmer on trade war: 'We're not seeing an end'

A meeting between President Trump and President Xi Jinping to sign a trade deal has been delayed until at least April.

In the meantime, farmers are still fighting to offset the effects of the tensions (and tariffs) between the U.S. and China. Mark Watne, president of the North Dakota Farmers Union, detailed these struggles.

Among members of his union, “their largest concern comes with the fact that their farm income is off about 50% from probably five, six years ago,” Watne told Yahoo Finance’s First Trade. “We’re not seeing an end to the trade war, and we’re questioning what a so-called win will look like.”

President Trump has made it clear that he’s “in no rush” to get the results he wants.

“I want the deal to be right,” he told reporters on Wednesday. “I am not in a rush whatsoever. It’s got to be the right deal. It’s got to be a good deal for us and if it’s not, we’re not going to make that deal.”

While this trade stalemate has been occurring, farmers have suffered major economic setbacks. The Wall Street Journal recently reported that American farmers are filing for bankruptcy “at levels not seen for at least a decade.” Though the trade war is not the only factor, it’s had a significant role.

“We’re seeing bankruptcies up by 98%, and farmers are trying to get their operating money put together this spring, and it’s going to be really hard,” Watne said.

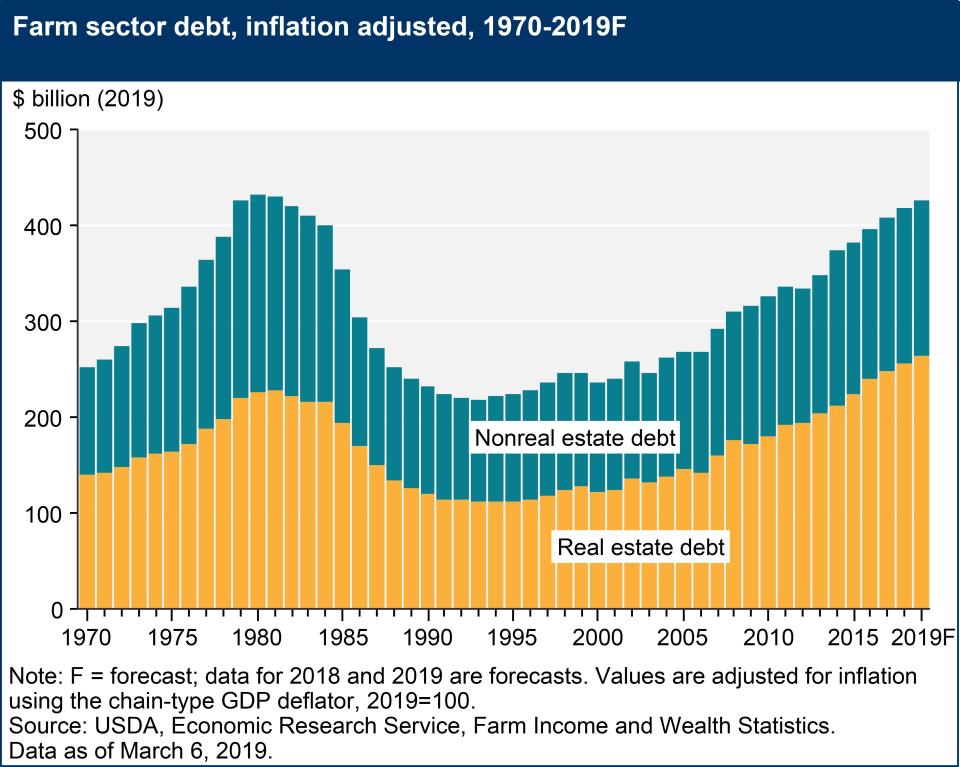

According to the USDA’s Economic Research Service, “farm sector debt is forecast to continue to increase in 2019 and outpace growth in farm assets [and] the farm sector’s risk of insolvency is forecast to be at its highest level since 2002.”

‘The bankers are getting quite sensitive ...’

Watne noted the “big impact” the trade tensions have had on these numbers, particularly by soybeans dragging down the rest of agricultural commodities. The Trump administration’s aid to farmers has provided some financial assistance, but it hasn’t been able to stop prices from going down.

“Even with some assistance, we’re probably still looking at $1 a bushel lower than what we should see, and none of the crops we grow right now really cash flow well,” Watne said. “So the bankers are getting quite sensitive whether or not you can actually make enough money to pay your bills back, and that drives people into this bankruptcy situation.”

The price of soybeans per bushel reached a high of $10.54 over the last year. It currently stands at $9.01. Part of this is due to oversupply — U.S. soybean exports to China are down significantly and there aren’t many other options of whom to sell the crops to.

As a result of decreased competition from the U.S., Russia and Brazil increased their soybean exports to China. Watne said that with trade being “a long-term relationship,” these new competitors could affect the U.S. longer than initially hoped for.

“When we look back in the ‘70s, when Russia was importing a lot of grain from us, we made the assumption they would do that forever, and the reality is they’ve become an exporter,” he said.

“Now, if we are an undependable partner with China and we’ve stepped out of the TPP where we’re not part of that with Japan and Australia and those other groups, it’s likely they won’t find us as being that reliable partner, and we could see lower commodity prices for years due to the fact that we’re in this war.”

‘We really need more demand’

It all comes down to whether or not U.S. trade officials can reach a compromise with China. Robert Lighthizer, the U.S. trade representative, is firm about putting an end to alleged intellectual property theft by the Chinese and has indicated more tariffs will be put in place if progress isn’t made.

Farmers, though, need the business from China to resume in the near future.

“We really need more demand and we need China to buy more from us,” Watne said. “We need some of the other Asian countries to buy from us, and we’ve got to find a way to use the food that we have. We’re just too good at production.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Analyst: There's a 35% chance U.S.-China trade talks break down

Trump’s farmer bailout just hit $7.7 billion – but 'it no way makes us whole'

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.