"2023 was a very successful year": Avolta looks ahead to long-term growth

Avolta is confident of long-term growth after a successful 2023 and a continuing strong performance into the New Year, according to the company’s comments related to its full-year results.

Avolta describes 2023 as a “transformative and successful year”. The company said it completed a “game-changing business combination, delivering its synergy targets in combination with an impressive set of financials in its first year”.

Avolta’s 2023 financial report highlights include strong overall business momentum with global passenger growth continuing in 2024; February year-to-date net sales growth estimated at 7% year-on-year (CER proforma). Growth across all regions contributed to Avolta’s core organic growth of 21.6% (proforma) while core EBITDA margin of 9% “significantly exceeds target”.

Avolta's strong performance in 2023

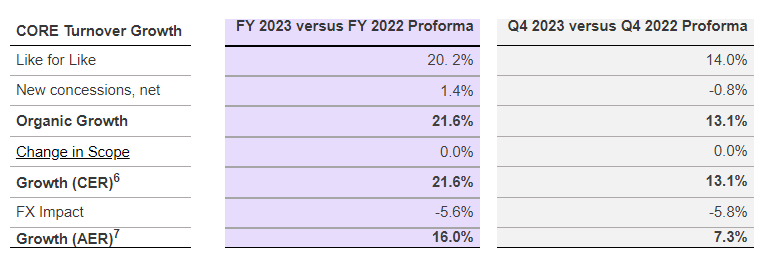

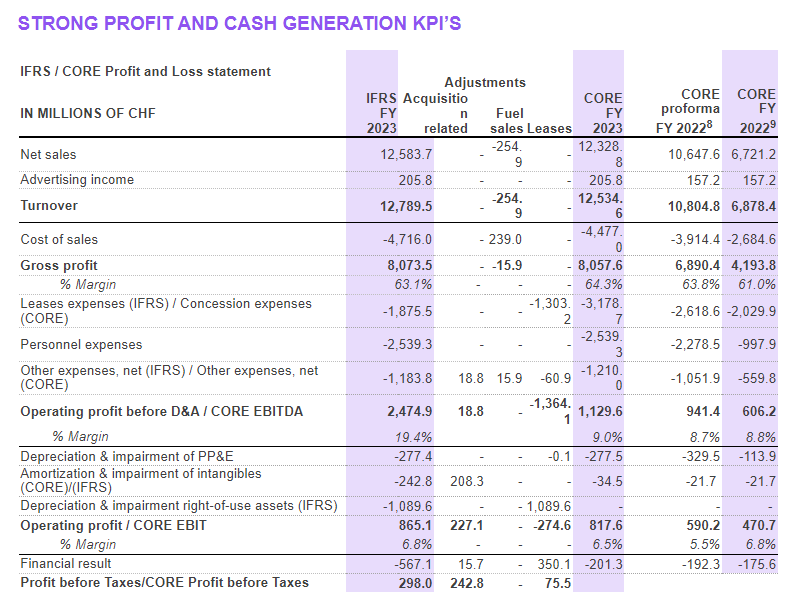

Reported turnover reached CHF12,789.5 million, with CHF3,210.6 million in Q4. Core turnover of CHF12,534.6 million, increased 16% compared to 2022 and core proforma organic growth totaled 21.6% (Q4 2023 13.1%).

The report notes a “completely successful” integration, with synergies of CHF30 million achieved in 2023 and run-rate synergies of CHF85 in 2024. The company’s operating profit was CHF865.1 million, core EBITDA to CHF1,129.6 million with a margin of 9.0% and a net profit of CHF216.4 million.

Further details of Avolta's success in 2023

Xavier Rossinyol, CEO of Avolta, commented, “2023 was a very successful year for Avolta. The company completed a transformational business combination redefining the global travel retail and food & beverage industry. This success is further reflected in Avolta delivering CHF30 million of synergies, which are set to increase to CHF85 million in 2024. With the launch of Avolta, the successful opening of our first hybrid stores and early signs of innovation initiatives, we have set the course for continued profitable growth and are driving the travel experience revolution.”

Rossinyol noted that, throughout its transformation, Avolta’s focus on consistent growth and cash generation remained resolute. “Further enhancing our geographical diversification, Avolta achieved particular success this year in strengthening our footprint around the world,” he said. “Highlights include the significant renewal of the vast majority of Avolta’s Spanish airport contracts for 12 years, our 15-year contract extension at Harry Reid International Airport in Las Vegas, alongside many other activities across Europe, Middle East, Asia Pacific, Latin America and North America.”

According to Rossinyol, 2023 saw Avolta meet its financial targets, “setting the foundations for sustainable, profitable growth as the globally leading Travel Experience player”.

“Looking ahead, the robust long-term global passenger outlook (4.3%5 CAGR 2023 – 2042) – is also seen in January and February – and is testimony to our enhanced market position to deliver profitable growth in 2024 and beyond. This, coupled with our strategic initiatives for passenger conversion, increased spend per head, and our strengthened diversification across geographies and business lines, bolsters our confidence to deliver in our strategic direction and our financial outlook.”

Rossinyol said Avolta’s journey towards Destination 2027 is supported by a “proven track record of meeting goals and redefining what is possible in our industry”.

“Our success is truly powered by our people. To our more than 76,000 Team Members across the world, committed to elevating the travelers’ experience: thank you. Your extraordinary dedication and the hard work that you have given this year, on the back of so much change, is remarkable and so very clearly contributes to the success of our company. Avolta’s success is our shared success.

“Our transformation to Avolta is a key milestone in our Destination 2027 strategy. It marked the emergence of a new and united company, standing as a distinct counterpart for our business partners and a new home for all our team members around the world. 2023 has delivered, and 2024 holds potential. #JourneyOn!”

Trading update

The strong performance in 2023 continues into 2024. Avolta estimates February year-to-date constant currency net sales growth of 7% proforma year-on-year, driven by strong passenger growth trends and continued execution on its travel revolution initiatives. While Avolta remains vigilant as regards the geopolitical environment and the broader economic backdrop, the company is optimistic on its outlook.

Integration and synergies

As part of the business combination, Avolta has implemented a new geographical organization. The resulting scale, enhanced operating model and integrated customer position gives Avolta significant competitive advantages. The company delivered cost synergies of CHF30 million in 2023, with full run rate synergies of CHF85 million expected as of 2024. Integration related costs amount to CHF50 million, and are equally split between 2023 and 2024.

Capital Allocation Policy and Dividend

In November 2023, Avolta announced its new capital allocation policy, as part of which the company intends to distribute one-third of future annual EFCF as dividends. A 2023 dividend of CHF 0.70 per share will be proposed at the Annual General Meeting this May. The remaining two-thirds of the annual EFCF will be directed towards deleveraging the balance sheet while retaining the flexibility to invest in strategic business development and small bolt-on acquisitions aimed at bolstering its long-term competitiveness. In total, the company has set a medium-term leverage target of 1.5-2.0x financial net debt/core EBITDA, with flexibility up to 2.5x. Avolta is confident in its ability to achieve this deleverage target in the near-term.

Outlook

Avolta expects the positive underlying trends supporting the FY 2023 results to continue into 2024 and beyond. Over the medium-term, the company anticipates CORE turnover to grow at constant exchange rates 5%-7% per year on average, underpinned by its global diversification, which in turn reinforces its resilience.