For years, everyone involved with investing has wanted to know: When will the Federal Reserve raise interest rates?

But there’s another important consideration that isn’t asked nearly enough: Can the Fed raise interest rates?

That query is more than academic. With the US economy looking increasingly strong, some still think the Federal Reserve could act to raise rates after its monetary policy committee, the Federal Open Market Committee, meets this week (Sept. 16 and 17).

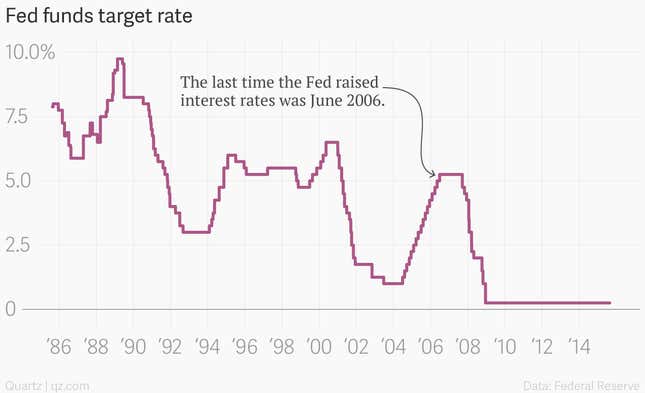

Such Fed rate increases used to be commonplace. But those days are long gone. It’s been roughly nine years since the US central bank last ratcheted up its once primary policy rate, known as the Fed funds rate.

And in the near decade since then, pretty much every rule, technique, and guideline the Fed once relied on has been drastically rewritten, revamped, or removed. That blank slate underscores the fact that seven years after the financial crisis, the US economy continues to feel the reverberations.

In the words of one analyst, when the Fed tries to raise interest rates, its “actions will entail the largest monetary policy experiment in human history.”

Here’s what you need to understand it.

How rates move

Once upon a time, the Federal Reserve altered monetary policy by raising and lowering its target for the Fed funds rate.

What are Fed funds?

They’re the reserves that banks have to hold—for large banks a 10% fraction of their deposits—by law. These funds are essentially for safekeeping, and can’t be invested. (Though since 2008 the Fed has had the power to pay interest on them.)

But funds in excess of that 10% ratio can be invested and lent out within the Federal Reserve system. This is the Fed funds market, where banks that have more reserves than they need lend to banks that don’t have enough, usually on an overnight basis. And the cost of borrowing money in this market is the Fed funds rate.

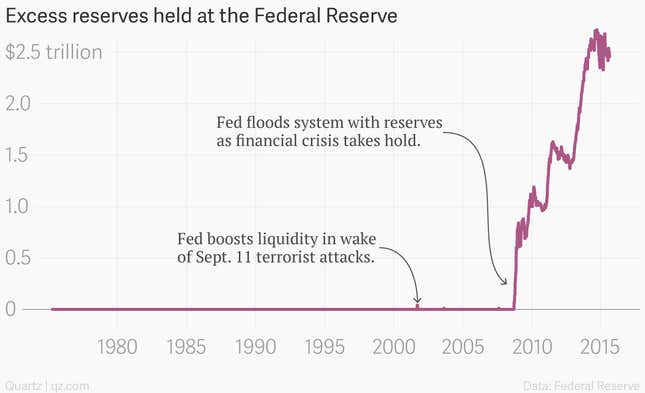

Here’s the problem: Right now, everybody has way more reserves than they need. That’s because the Federal Reserve has pumped large volumes of reserves into the system in recent years, in an effort to first contain the financial crisis and, later, support economic growth.

How did the Fed push these reserves into the system? Easy. It created them out of thin air, and used them to buy government securities from banks.

And why did it do it? To push interest rates down. (Supply and demand creates prices. All else equal, a rising supply of reserves pushes the price of reserves—the Fed funds rate—down.)

Here’s the trick: Traditionally, in order to raise interest rates, the Fed has to find ways to suck some of those reserves back out of the system.

But that’s gotten a lot harder to do.

Getting the genie back in the bottle

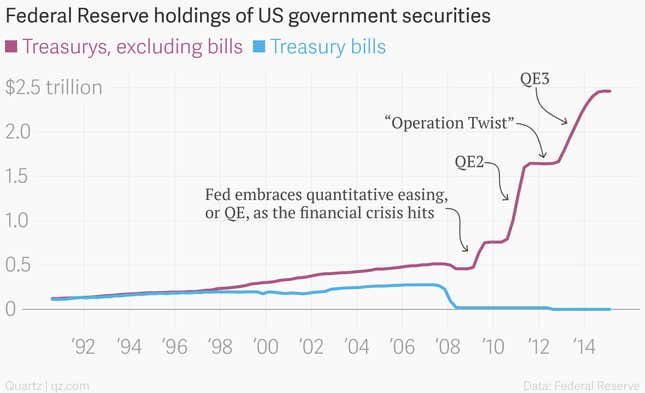

The Fed used to have a really simple and effective way to slurp bank reserves out of the system and raise short-term interest rates; it sold securities, often out of its stockpile of short-term US Treasury bills.

By selling bills, the Fed withdraws reserves by accepting them as payment. That reduces the supply and raised the price of reserves, i.e., interest rates.

And it worked well in the pre-crisis era when the Fed was trying to manipulate a much smaller market.

But today there are $2.5 trillion in reserves. By comparison, at the end of July, there were only $1.4 trillion of US Treasury bills in existence. In other words, there’s nowhere near enough Treasury bills to soak up the amount of reserves the Fed has created.

And at any rate, the Fed doesn’t have any Treasury bills left. It has effectively let its holdings of Treasury bills mature, leaving it with none to sell as a way to pull money out of the system and raise rates. That’s because the Fed long ago realized that there was more than enough reserves around to keep short-term rates at zero.

But the Fed still thought it needed to do more to help the economy. So it started buying longer-term US Treasury bonds—unlike bills which are shorter-term government debts, bonds mature over a period of a year or longer—using an unconventional monetary policy known as “quantitative easing.” You can see the process in action in the chart below, which shows the Fed’s Treasury bill holdings withering away as its holdings of longer-term Treasury bonds explodes higher.

Why doesn’t the Fed sell its Treasury bonds then?

Because there’s no one buyer big enough to purchase them. The Federal Reserve itself is now the world’s largest holder of US government debt, after its bond-buying programs pushed its holdings above those of China.

If the Fed tried to sell its bond portfolio it would likely tank the market and cause interest rates to spike, undoing much—if not all of—the beneficial economic effects its efforts have achieved over the last few years.

So what will it do?

The Fed will dig into its new toolbox.

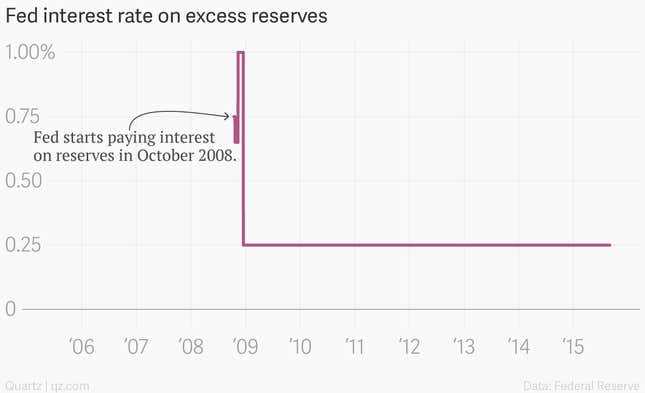

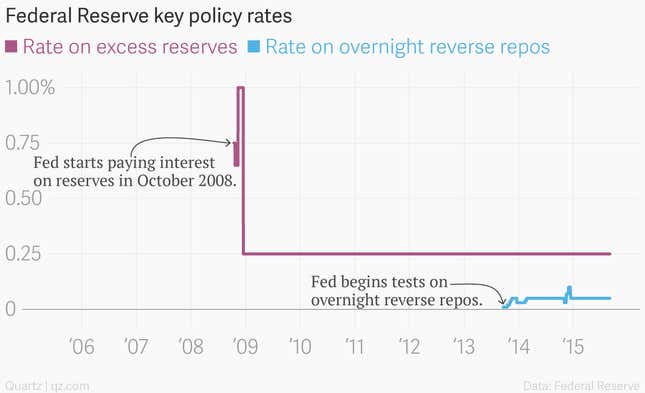

Since the financial crisis, the Fed has been able to pay interest on reserves that banks sock away at the central bank. Basically, it has the ability to pay banks to keep their money sitting idle at the Fed.

The Fed is by definition the safest place to put your dollars in the world—because it has the ability to create any money in might need to pay you back.

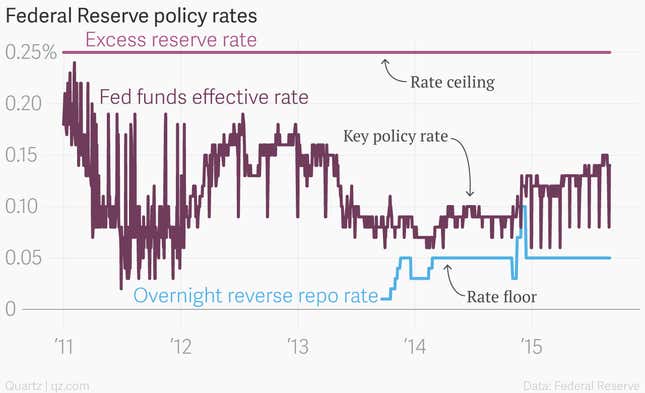

As such, in theory, no bank should be willing to lend money for less than the Fed is willing to pay. (After all, why would you take more risk for a lower return?) So the Fed’s original plan for raising interest rates this time was to raise the interest rate it pays on reserves, which should act as a kind of magnet that would pull the Fed funds rate higher.

There is one problem, though. The Fed can only pay interest on reserves to one type of institution: banks.

But there are plenty of other entities that lend their mounds of cash in the short-term debt markets where the Fed is trying to influence interest rates. And their willingness to lend money for less than the Fed’s rate could keep short term interest rates below the Fed’s reserve rate. For example, the network of 12 Federal Home Loan Banks, a Congressionally chartered system that lends money to member banks that make housing loans, has been an active lender in the Fed funds market, often charging less than the Fed’s rate on excess reserves. Their willingness to lend at lower rates has put downward pressure on the Fed funds rate, Fed officials have said publicly.

So, the Fed will try to soak up some of that non-bank money with another tool, which is called overnight, reverse repurchase agreements (ON RRPs). What are those? Essentially, they’re like overnight deposits the Fed can accept from a much broader bunch of financial institutions than banks. The interest rate on those ON RRPs is supposed to act as a kind of floor for short-term interest rates, while the rate on reserves is supposed to act as a kind of “magnet” to lift rates higher.

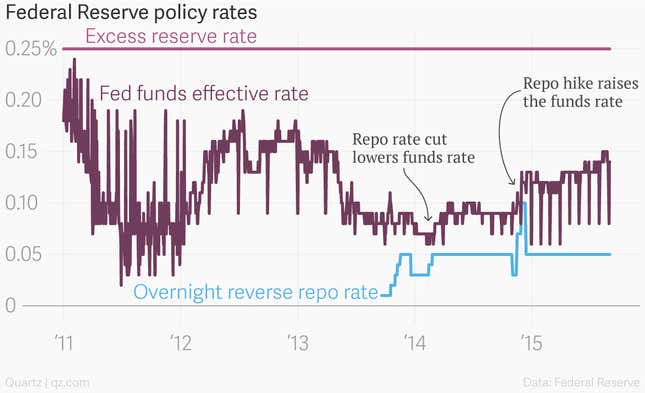

And the idea is that by manipulating these two rates, the Fed will be able to control other short-term interest rates, including the good old Fed funds rate.

Are we sure it will work?

The company line out of the Fed is that the central bank is sure it can lift rates.

“The committee is confident that it has the tools it needs to raise short-term interest rates when it becomes appropriate to do so,” Fed chair Janet Yellen told Congress earlier this year, adding, “and to maintain reasonable control of the level of short-term interest rates.”

And there have been some instances where the Fed moved its overnight repo rate and it seemed to have the desired effect on the Fed funds rate.

But there are still big questions. Will the Fed be as effective at manipulating rates in the US repo market as it was in a Fed funds market back in the good old days? In the US repo market some $2.3 trillion worth of trades are done every day. That’s a huge market to move.

It’s so big in fact, that the Fed said back in April that it might lift the $300 billion cap it had on daily overnight reverse operations.

Ripple down the curve

All of this effort and planning is merely to get short-term interest rates off the floor. But that’s only half the battle.

The Fed traditionally moves short-term interest rates and then relied on markets to move rates on things like the 10-year Treasury note. Those longer-term rates influence everything from corporations issuing bonds to would-be homeowners securing mortgages.

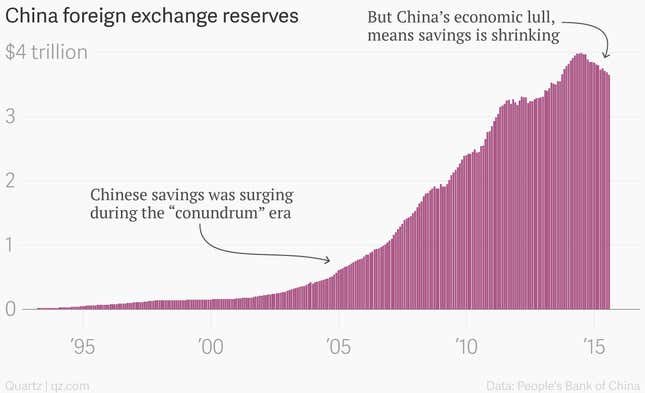

That hasn’t always work as planned. In 2005, then chairman of the Federal Reserve, Alan Greenspan, famously called the stubborn refusal of long-term bond yields to rise a “conundrum.” His successor Ben Bernanke thought that it was a “global savings glut” among emerging market nations—savings that were invested in US Treasurys—that kept long-term interest rates lower than they should have otherwise been.

The situation is a bit different today. Giant entities like China are actually burning through their savings a bit to keep their currencies propped up. On the other hand, with disinflation and deflation major macroeconomic forces, people are more than willing to buy safe government bonds with low yields, which acts as a headwind against higher rates.

But those are all challenges for another day. The Fed doesn’t need or want to push long-term interest rates sharply higher. It merely wants to prove that, nine years later, it still has the market muscle and technical know-how to get rates up and keep them there. Let’s hope they know what they’re doing.