The Single-use Bioprocessing Bottleneck & Looking Ahead

By Paul Spencer, BioPlan Associates

Are you asking, What happened to the bags promised for my product? The single-use system (SUS) bag market had been seeing strains as early as 2018, when vendors were scaling up to meet market demand for various SUS devices. When COVID-19 hit, Operation Warp Speed resulted in vendors focusing on providing materials for the pandemic markets, especially on the vaccine and therapeutic targets that were biologically based.

According to BioPlan’s 2021 18th Annual Survey and Report, as well as ample anecdotal evidence, there were impacts on the supply of bags due to an increase in raw material shortages even while there was a significant increase in the demand for SUS bags for non-COVID-19 products.1 SUS systems are seeing significant increases in use in both up- and downstream processing. Delays of up to one year for companies wishing to move to SUS or requiring a specialized design have been seen by some industry observers. The reasons for the delays in the supply stream are complex and involve raw materials shortages, logistics, increased demand from emerging regions including China and India, and the inability to get materials where they need to be.

Raw Material Shortages For SUS Manufacturers

Currently, there are increasing supplier lead/wait times for single-use equipment due to a shortage of high-purity polymers for single-use products These problems were present before the arrival of COVID-19, which closed many petrochemical processing facilities worldwide.

Of course, sourcing biologics SUS devices used in GMP applications is more challenging compared with other products. Documentation regarding leachables/extractables, being animal products-free, BSE/TSE testing (where animal products have been used), and other supply chain information is critical and simply a normal part of the responsibilities all manufacturers and vendors have to their customers. Ideally, these should not become end-user concerns, and all required information would be included by suppliers with purchases. However, this is a challenge for some companies, and the pandemic has intensified some of these problems. BioPlan market research studies find end users reporting increasing problems with their suppliers’ products’ performance and support services.1

Expansion Of Steps Using SUS

A growing portion of the biopharma industry is using or investigating SUS for up- and downstream bioprocessing. The industry has seen a significant expansion into the downstream processing areas that looks likely to continue. This can include both product handling as well as buffers in bags. Fermentation, cell culture, vaccines, and other segments can all have their own specialized SUS niche.

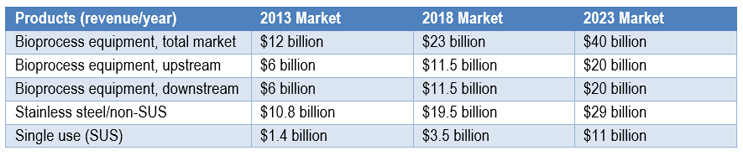

Fig 1: Product Revenue for 2013, 2018 and 2023 Markets

Fermentation requires a different filter than the others. Mixers are generally designed for gentle lift of cells in combination with gases from a sintered metal filter, very fast mixing of buffer components without protein, and the product holding bags tend to be focused on efficient mixing throughout the bag. These different designs have multiple other points that might make a process bag require specialized designs. The degree of specialization reflects added time to get the bag in hand, which could add to the time to get the product to market.

The expansion of use into the downstream market continues to accentuate the shortage of bags. Single-use disposable systems used in downstream processing remains an area where both end users and systems manufacturers would like to see improvements. End users have identified downstream processing, including chromatography, as a major area where they would like to see innovations by suppliers. With chromatography, there simply continues to be a lack of SUS, and the available options include rather complex multi-column chromatography systems, while single-campaign prepacked reusable/recycled (potentially single-use if not returned to the supplier) chromatography columns are seeing rapid adoption.

Even before COVID, growth in these areas was creating longer wait times and shortages of SUS devices. The pandemic created even longer delivery times and intermittent shortages. To deal with this supply chain risk, many facilities, and even some suppliers, have been recommending preordering, warehousing, and stockpiling raw materials including buffers, tubing, and other single-use devices. This has led to even longer wait times in some instances, especially for smaller facilities, which often feel they do not get the priority service that larger facilities are offered.

CDMOs Driving Demand: Use Of SUS Vs. Stainless Steel

Over time, CDMOs and product developers/manufacturers have been integrating SUS into most or all their bioprocesses, wherever they can. This continuing shift will be dictated by economics, risk reduction, and speed. CDMOs are highly motivated by the need to get their facilities and projects up and running as quickly as possible, while generally using supplies specified and paid for by their clients. CDMOs often use disposables to speed up processing and process changeover time and reduce risks of cross-contamination between various campaigns/projects. In addition, an increasing number of CDMO facilities are essentially fully single-use. Biopharmaceutical manufacturers, with unending manufacture of their commercial products, tend to be more motivated by the need to keep maintenance and operating costs low in the long term, while also placing even more emphasis on regulatory compliance and safety.

If suppliers and/or associated standard-setting bodies can develop more and better methods for standardizing SUS, it would enable more secondary (other) vendors to make competing equipment, which is an important but missing factor today. Having needed equipment available from only a single or few sources is not a good situation for any bioprocessing equipment user, with backup sources generally desired or needed, and limited competition likely contributing to higher prices.

CDMOs’ use of SUS can save on facility and campaign costs, which can also reduce operating costs and capital investments. The flexibility and quick turnaround times between process runs and different client projects allowed by single-use equipment can also improve CDMO efficiency, which can reduce costs. These savings can be passed on to a CDMO’s clients and, ultimately, to the patient, while increasing perceptions of the CDMO’s cost-benefit position and, potentially, increasing CDMO profits, as commercial manufacturing is the most cost-effective and profitable for CDMOs. Being able to perform different processes within the same facility more rapidly is a definite benefit.

There are differences between CDMOs and product developers with respect to the top reasons for using SUS and the perceived benefits. These differences reflect the CDMO business model, which involves manufacturing many more products as quickly as possible, while developers often have years to develop their bioprocessing.

For CDMOs, reduced capital investment and faster turnaround can result in better return on investment to maintain business edge. In many respects, equipment-related capital investments not directly reimbursed by current clients represent major costs for CDMOs that must be recovered from their clients. If a piece of capital equipment is required, an individual client may require the cost be assumed by the CDMO. The CDMO will frequently ask the client to pay a portion of the cost but assume the asset as part of the project. The situation may result in the asset being reused for a future project or being scrapped.

Concerns About Testing Data

Some end users of SUS continue to consider single-use testing data provided by suppliers to not be fully adequate. They struggle with generating the testing data and documentation needed to satisfy their own and regulators’ concerns about related adverse effects on product quality. This need for specialized testing can slow adoption or acceptance of new SUS devices, for example.

Some purchasers are restricting the use of single-use devices, at least to some extent, due to persisting concerns regarding leachables and extractables or perceived other problems with adoption of SUS. SUS suppliers often have limited control over and access to information about polymers and other raw material sourcing, putting the end user at a disadvantage with limited transparency into the supply chain. Regulatory agencies hold the end user responsible for controlling all raw material changes, even by distant upstream suppliers. The limited access to supplier data remains a difficult challenge for end users. These are not new problems, having been reported in surveys every year now for a decade or more.

End users often feel suppliers are in a better position to test and should provide any necessary leachables and extractables data, consistency testing, and supporting documentation for their own products. The desire for this type of data is strongest among smaller and scale-up/clinical development organizations that do not have the resources to conduct such testing in-house or otherwise have less experience with leachables and extractables. A good portion of the largest facilities, generally those manufacturing commercial products, often prefer to fully generate leachates and extractables data in-house, giving them full control of test design and documentation and allowing better consistency when testing products from different suppliers.

Related to supply chains, standardization, such as methodology for leachables and extractables assays and documentation of results, is a concern. Bioprocessing standards setting/recommending organizations, e.g., BPSA, BPOG, ASTM, and ASME BPE, are working to address the industry’s concerns but sometimes with limited results due to the need for a slow, consensus-seeking approach.

Use Of SUS Expanding In China And India

As new regions, such as China and India, begin to produce both innovative biopharmaceuticals and biosimilars, even if only for their domestic markets, the need for consistent quality and GMP compliance may dictate the greater use of SUS. This is because SUS can be implemented more efficiently, more rapidly, with fewer risks of quality problems and with much less required infrastructure and fewer staff. As new biomanufacturers enter the industry and new products enter the pipeline, the SUS option will become part of more developers’ decision-making processes from the very start. SUS can help smaller and startup organizations, and those in less developed regions, become more effective and more competitive. And as developing country-manufactured SUS devices that perform similar to mainstream vendors’ systems become available, we can expect their increased use in developing countries and, perhaps, related price competition in major markets.

COVID-19 Competing With Other Technologies

As the industry drives in the direction of SUS, a significant portion of the biopharma industry’s responses to the COVID-19 pandemic has resulted in a rapid increase in the use of SUS, particularly for commercial vaccines and therapeutics manufacturing.2 With both the massive bioprocessing need and the impact of COVID-19 requirements, there continues to be a rapid ramping up of cellular and gene therapy capacity. The result is that the already long average lead/wait times for suppliers to fill single-use orders will likely only worsen. As competition among SUS manufacturers increases, related raw materials sourcing, i.e., supply chains, across the globe are continuing to be a major concern for end users.

Conclusion

The biopharma industry continues to grow at a rapid rate. For example, the consistent ~12% increase in revenue that has been seen in mainstream therapeutic biologics over at least the past 10 years, the expansion of developing regions such as China and India, and the advanced gene and cell therapies that are rapidly making their way through the development pipeline are all contributing to growth and bottlenecks as they compete for limited resources. The move of SUS into additional steps in the process and the loss of some raw material sources are also contributing to delays in the delivery of standard and modified design bags. There are simply too many organizations targeting the small number of vendors able to sell these products.

The law of supply and demand will, eventually, even out this imbalance. New suppliers, in new regions and old, are already entering the market. Some of these new suppliers have better technologies. But with the pandemic inserted into the mix, the normalization of the supply chain may continue to be delayed.

References

- Langer, E.S., et al., Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 18th annual edition, BioPlan Associates, Rockville, MD, April 2021, 491 pages.

- Rader, R.A., Langer, E.S., and Kamna Jhamb, Ph.D., BioPlan Associates, Inc. “Covid-19’s Impact on Bioprocessing: Insights from Industry Leaders”, Pharmaceutical Online, August 5, 2020.

- Langer, E.S., Rader, R.A., “Biopharmaceutical Manufacturing is Shifting to Single-Use Systems. Are the Dinosaurs, the Large Stainless-Steel Facilities, Becoming Extinct?”, American Pharmaceutical Review, October 233, 2018.

About The Author:

Paul Spencer of BioPlan Associates is a pharmaceutical veteran with over 37 years of experience, with nearly 30 years of work in the biological products arena. He has enjoyed focus points from research, through development, into continued support of commercial facilities. His experience includes fermentation, purification, formulation, and fill/finish areas. His specialized expertise lies in primary and secondary research, competitive intelligence, and market analysis of healthcare and biopharma segments, including developing API technologies. He earned a BS in chemical engineering and an MBA. He can be reached at pspencer@bioplanassociates.com, +1 301-921-5979.

Paul Spencer of BioPlan Associates is a pharmaceutical veteran with over 37 years of experience, with nearly 30 years of work in the biological products arena. He has enjoyed focus points from research, through development, into continued support of commercial facilities. His experience includes fermentation, purification, formulation, and fill/finish areas. His specialized expertise lies in primary and secondary research, competitive intelligence, and market analysis of healthcare and biopharma segments, including developing API technologies. He earned a BS in chemical engineering and an MBA. He can be reached at pspencer@bioplanassociates.com, +1 301-921-5979.