ABOUT THE SURVEY

In October of 2021, Redtail Technology conducted its “Financial Planning Career Perceptions 2021” survey to learn more about the views of industry professionals and financial planning students regarding career preparation and expectations. Additionally, the survey aimed to gain a greater understanding of the certification goals by students, skillset demand for the next generation of financial planning professionals, employer outlooks, and employee retention.

Based on the data collected from the survey, Redtail set out to understand:

- If students understand what certifications/licenses they need for their careers

- How well academic programs prepare students for a financial planning career

- What the next generation of financial planners is looking for in an employer

- What employers are looking for in the next generation of financial planners

- What, if any, communication gaps exist between experienced financial professionals and incoming professionals

METHODOLOGY

Redtail surveyed nearly 4,300 financial professionals and students across the United States, including 224 financial planning students from Brigham Young University-Idaho. Of the 4,257 respondents, 4,033 were financial professionals and they were split into two categories — “RIA” (Registered Investment Advisor) and “Non-RIA.” Student respondents are investigated by gender, age, ethnicity, and desired career (RIA vs non-RIA).

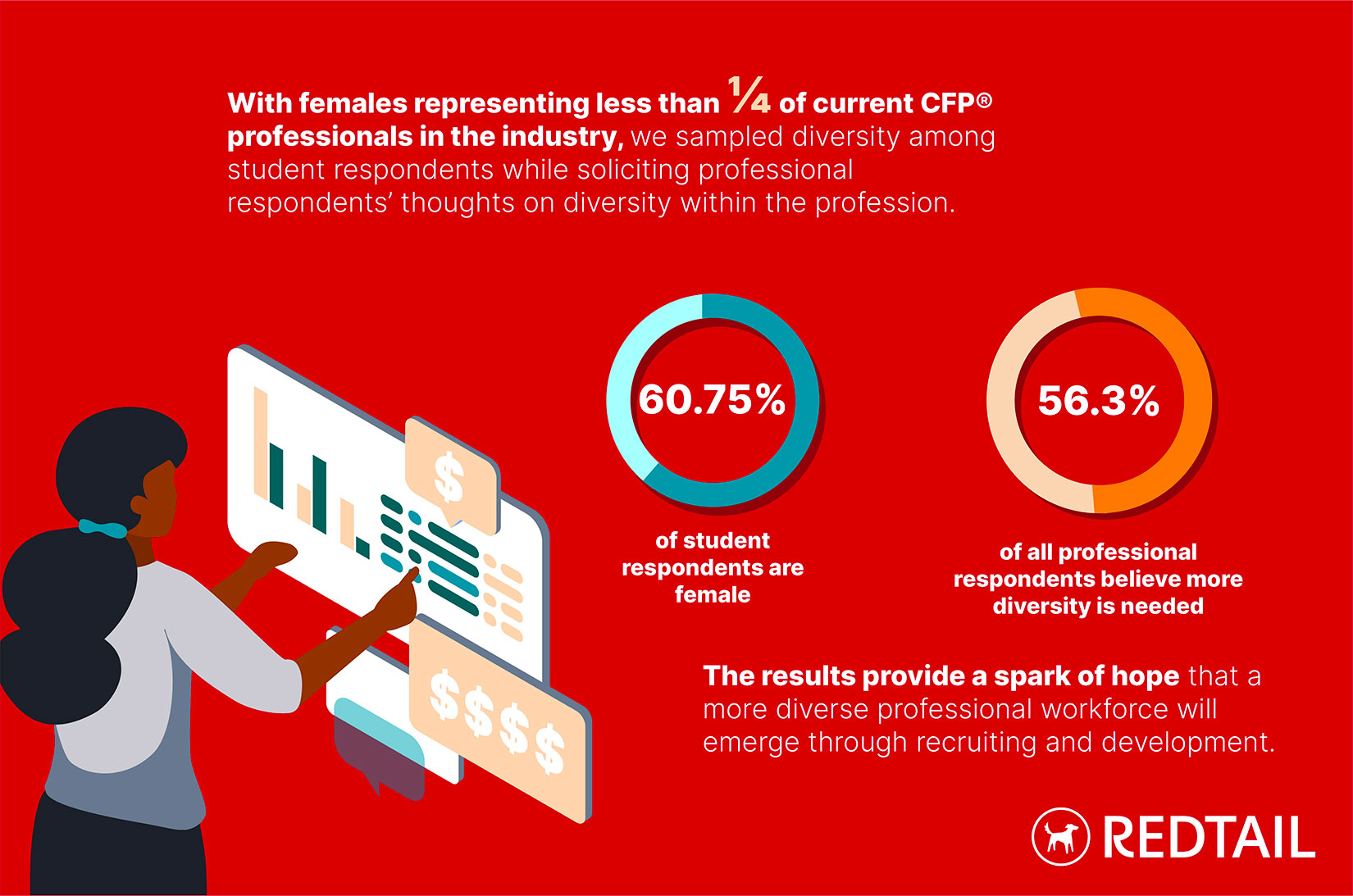

Considering that less than one in four CFP® (Certified Financial Planner) Professionals currently in the industry are female, the survey took this opportunity to sample the diversity within the student cohort while also asking current professionals their thoughts on diversity within the profession. The results provide a spark of hope that a more diverse professional workforce will emerge given that 60.75% of student respondents are female and more than half (56.3%) of all professional respondents (48.7% male, 47.5% female, 3.8% undisclosed) believe that the industry needs to improve recruiting and development efforts for more diverse applicants.

KEY FINDINGS:

- Students are not quite as focused on pre-graduation certifications as professionals would like

This is possibly due to the huge number of certifications and licenses on offer, what many in the industry call the “alphabet soup”, that are presented to students. This can overwhelm students and detract from a focused effort on earning the professional certifications and licenses that will be most beneficial to their careers. While the vast majority (71.2%) of current RIA professionals surveyed recommended sitting for the CFP® exam prior to graduation, less than 17% of students surveyed indicated they’d set this pre-graduation goal for themselves.

Additionally, female students showed less of an interest in CFP® certification than male students. Caucasian respondents placed emphasis on obtaining the Series 65 license well ahead of the CFP® certification and only 11% of non-Caucasian students sought to pass the CFP® exam before graduation (Asians: 28.5%, African American: 0%, Other: 8.1%).

- Academic programs are adequately preparing students for a financial planning career

More than half of professionals surveyed (57%) believe that academic programs are adequately preparing students for a financial planning career compared to the 43% of professionals who believe they are not. This may seem like an underwhelming endorsement of academic programs, but these survey results point to significant progress in the last few years. In 2018, an InvestmentNews poll found that nearly 80% of respondents felt “schools should be doing more to prepare students”.

By breaking down our survey results further, we also found that younger professionals (under age 35) are more satisfied with efforts by academic programs than older professionals (age 35+).

- Salary, company culture, and quality management are common drivers of both students’ and professionals’ perceived job satisfaction

Students and professional respondent groups agreed on the top three things they were looking for in an employer. However, the groups placed these three reasons as to why they would choose one employer over another in different orders. The majority (over 40%) of student respondents said that salary/opportunity for advancement was the main driver of job satisfaction. Perhaps the thought process was, “if we are getting paid enough, we can overlook other things that may be lacking within the firm.”

On the flip side, the majority of professionals surveyed believe that an employer should be able to keep talent by offering a great firm culture. This makes sense within an older demographic, who, perhaps by design, may have spent most, if not their entire career working for the same firm. If an employee feels comfortable with the culture at a firm, it may reduce their thoughts of moving on, whereas students may find it difficult to assess the value of company culture due to lack of experience.

Of course, all of these responses represent a snapshot in time and one should likely at least consider outside factors, temporal or not, such as The Great Resignation we’ve been in the midst of (including during the time when this survey was administered), and how those factors play into job satisfaction (both perceived and real).

- Skilled professionals and students are aligned in putting emphasis on the importance of interpersonal skills

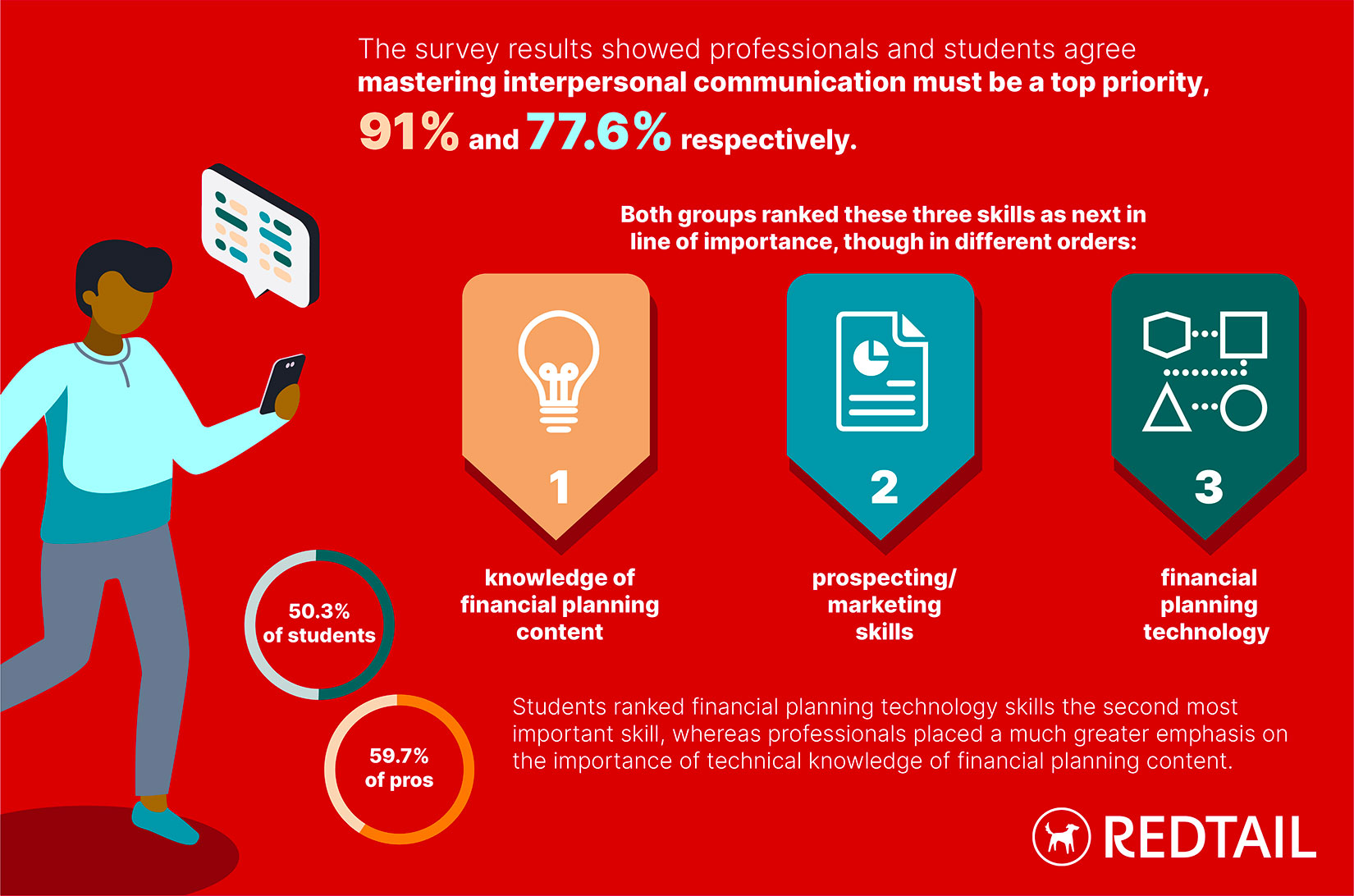

The survey results showed that professionals and students agree that mastering interpersonal communication must be a top priority, 91% and 77.6% respectively.

“When I saw this data point in particular, I saw it as an opportunity for those of us in academia to push the envelope a little further to the greater benefit of our current and future students,” said B. Taft Dorman, PhD, AFC, an adjunct professor in the finance department at BYU-Idaho who participated in analyzing the survey data along with his students.

Both groups ranked technical knowledge of financial planning content, prospecting/marketing skills, and financial planning technology skills as the three next most important skillsets, though students (50.3% of them) ranked financial planning technology skills the second most important skill, whereas professionals (59.7%) placed a much greater emphasis on the importance of technical knowledge of financial planning content. This finding reinforces the emphasis professionals place on sitting for that CFP® exam while still in school in order to bolster the preparation and training students will need for a successful career.

- Perceptions of communication gap and barriers to entry

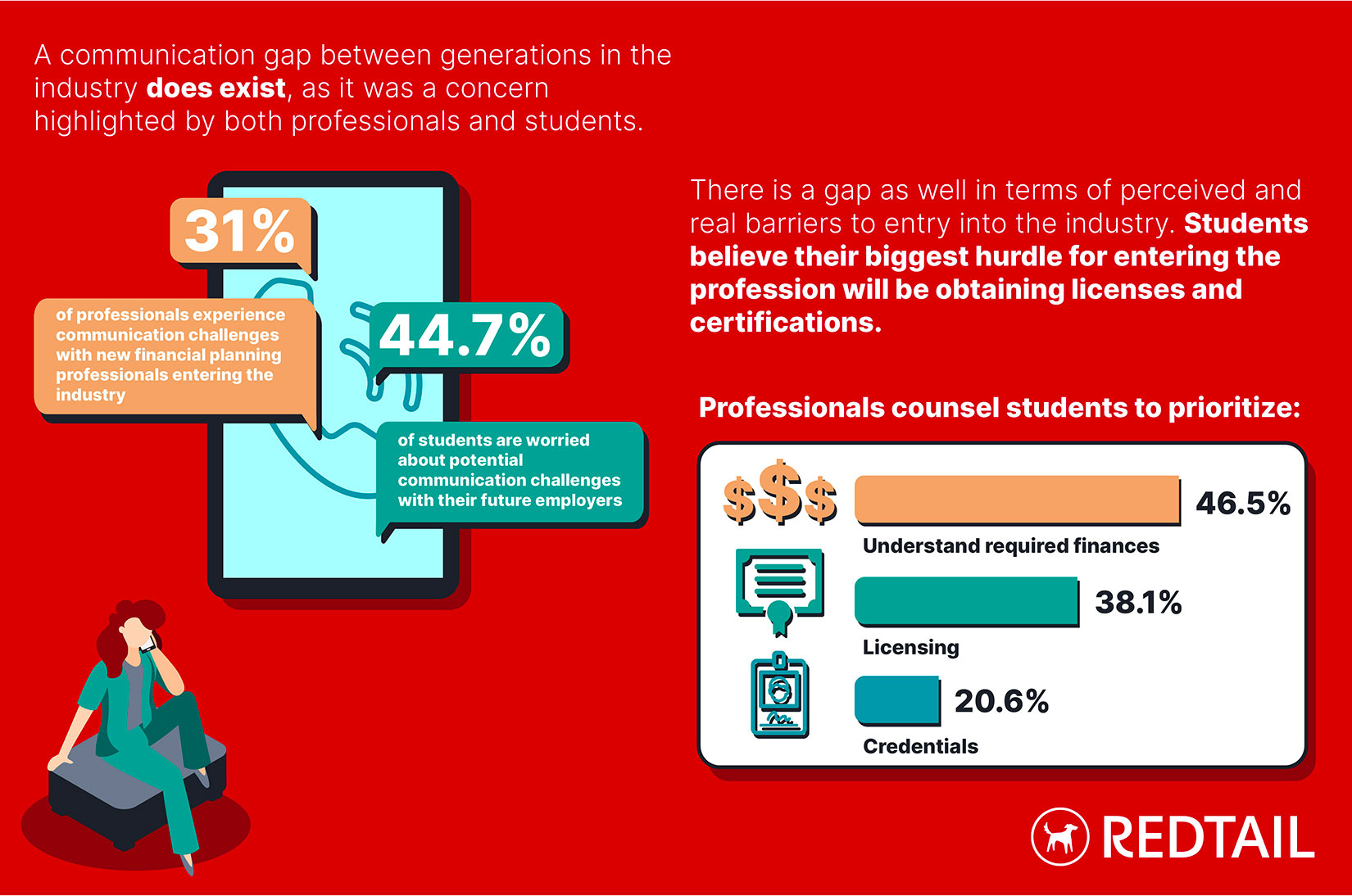

A communication gap between generations in the industry does exist, as it was a concern highlighted by both groups. 31% of professionals, regardless of age, ethnicity, gender, or firm type (RIA vs Non-RIA), experience communication challenges with new financial planning professionals entering the industry, while 44.7% of students are worried about potential communication challenges with their future employers.

There is a gap as well in terms of perceived and real barriers to entry into the industry. Students believe their biggest hurdle for entering the profession will be obtaining licenses (56.8%) and certifications (41.8%). Survey results, however, support professionals counseling students to better understand the finances required to enter the profession (46.5%) ahead of licensing (38.1%) and credentials (20.6%).

CONCLUSION:

Many of these discrepancies between the professionals’ lived experiences vs. students’ expectations could be addressed within the university system; both parties as well as the profession could benefit from a more transparent and consistent link between financial planning students and the professionals they hope to one day work alongside. The results of this survey support the idea of professionals counseling the students to help them better understand what is expected of them once they enter the working world.

Emphasizing a mastery of interpersonal communication, aligning certification exam efforts with desired employer type, and increasing focus on technical knowledge of financial planning topics are all actions which financial planning academic programs could address more fully over the course of a student’s degree. Firms too could play a larger role during these formative college years, partnering with those institutions they rely upon to produce quality candidates in meaningful ways that will set their students up with the knowledge they need to plot a more efficient path toward career success.

Brian McLaughlin, CEO of Redtail Technology