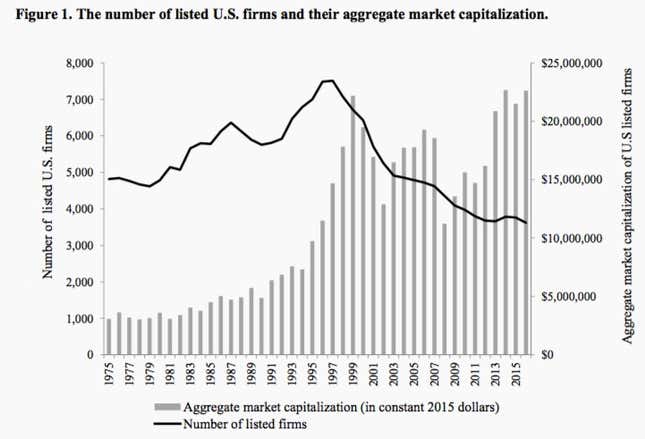

Going public was once a sign of a young startup’s promise. But these days, a growing number of young companies are avoiding IPOs altogether. In 1997, the average age of US-listed firms was a sprightly 12 years old. Now the average age is 20. US public companies have also gotten bigger. Between 1975 and 1991, around half of listed companies had a market capital of less than $100 million (in 2015 dollars)—compared with 22% in 2016.

This all adds up to an astonishing fact: The US now has “abnormally few listed firms,” according to a new working paper (registration required) from the National Bureau of Economics. (The paper hasn’t been peer-reviewed.) In 1997, more than 7,500 American firms were listed publicly in the US. Nearly two decades later, in 2016, the number had dropped more than half, slipping to 3,618 firms.

The crux of the issue is that US startups are increasingly shunning stock market boards. That could have worrying implications for America’s long-term economic prospects.

One big reason young companies are shying away from IPOs is that public listings don’t offer much benefit to promising startups, say the paper’s authors, economists Craig Doidge, Kathleen Kahle, Andrew Karolyi, and René Stulz.

In fact, going public can hurt them.

The upside of public listing is that it lets companies raise huge sums of capital, issue more shares, issue debt with relative ease, and use equity to fund acquisitions. But because of the ways the American economy has evolved, those advantages are less important than they once were.

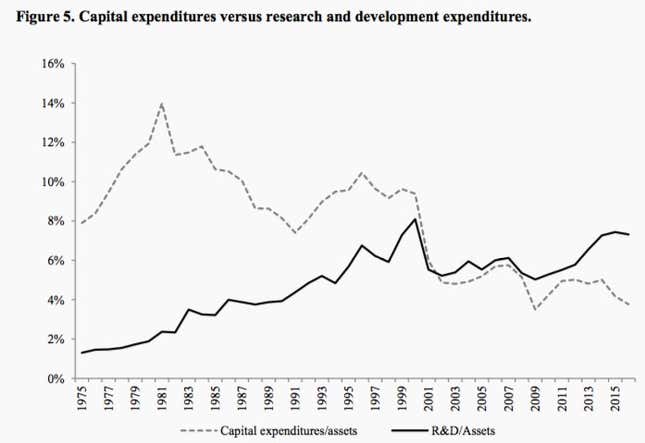

When industry powered US growth, companies grew by spending on capital investments like factories and machinery. Back in 1975, firms once spent six times more on capital investments than they did on research and development. But as the US shifted toward a services and knowledge-based economy, intangible investments became increasingly important. In 2002, R&D expenditures for the average firm surpassed capital expenditures for the first time. It’s stayed that way since; nowadays, average R&D spending is roughly twice that of capital expenditures.

The problem is, two features of public listings—disclosure and accounting standards—make things tough on companies with more intangible assets.

US securities law requires companies to disclose their activities in detail. But startups are wary of sharing information that might benefit their competitors.

“If a firm is building a new plant, it is easy for it to disclose that it is doing so. Nobody can steal the plant,” write the authors. Not so for R&D. “By disclosing details of that program, a firm gives away some of its ideas. Other firms can build on what they learn.”

Startups planning IPOs therefore face a big dilemma. Reveal too much, and competitors might steal your idea; disclose too little, and investor uncertainty will drag down your share price.

A similar problem stems from US accounting standards for public listing. Known as Generally Accepted Accounting Principles, or GAAP, these typically treat spending on tangible things like new equipment as assets, which doesn’t affect the firm’s profitability. However, GAAP regards intangible assets—research staff, employee training, and brand-building, for instance—as costs that eat into the firm’s profitability. So spending that could yield wildly profitable new products looks wasteful on paper. That makes it much harder for public investors to assess a firm’s value.

Luckily for small companies with promising ideas, there’s plenty of private money sloshing around in the form of venture capital and private equity. And it’s often easier and less risky to convince a VC fund’s in-house experts of the value of your idea than to persuade many hundreds of thousands of prospective shareholders and the financial media.

So what’s there to worry about?

One issue is the narrowing of investment opportunities for working Americans. The supply of US public equities is shrinking relative to the population—from 22 listed firms per million American residents in 1975 to 11 these days. For the most part, only rich people can hand their cash over to venture capitalists and private equity groups to invest in young firms. That means small-time investors have no way of investing in most of the new, fast-growing startups, according to the authors. Already, around half of Americans have not a single dollar invested in stocks, even including pensions or retirement savings plans. Cutting off most of the remaining investors from a way of investing in the economy’s most innovative sector is only going to worsen America’s already yawning wealth gap.

Another source of disquiet is intensifying industry concentration. In theory, the increased competition in startup land implies lower prices for consumers. The concern, however, lies in what happens to those that succeed. Instead of IPOs—the old-school way of letting early investors cash out—startups are holding out to be acquired by bigger companies. On top of that, smaller companies that are listed are increasingly prone to delisting because of mergers.

According to the financial economics orthodoxy, mergers boost efficiency. However, that might not apply to the sort of mergers happening of late. The NBER paper’s authors cite research (registration required) by economists Bruce Blonigen and Justin Pierce showing that gains from mergers come from a resulting decrease in competition. After all, as Quartz noted in a story on previous research by Kahle and Stulz, “the bigger and richer the market Goliaths get, the harder it is for the Davids of the US economy to lethally bean them.”

Finally, there’s the societal benefit that stems from the institution of public capital markets. Sure, public companies have gotten so mammoth, complicated, and powerful that, even with disclosure rules, it’s hard enough to tell what they’re up to. But at least they face a legal obligation of public transparency. As the number of those listed firms dwindles, a rising share of important American companies will operate in the relative comforts of opacity.