ATMP Report Identifies Outsourcing Realities

By Louis Garguilo, Chief Editor, Outsourced Pharma

Progress by organizations pursuing what we collectively call advanced therapy medicinal products (ATMPs) will continue to lean heavily on outsourcing and external partnerships.

Interestingly, the Gene, Cell, & RNA Therapy Landscape Q1 2022 Quarterly Data Report from The American Society of Gene & Cell Therapy (ASGCT) and Informa Pharma Intelligence, speaks volumes about outsourcing without ever mentioning the word.

Or “CRO” or “CDMO.”

Obviously, that isn’t the authors’ focus, but it must be increasingly difficult to present such reports (which, as we’ll see, include discussion on funding streams, for example) without mention of the actionable research/development, and ultimate processing and manufacturing, that takes place at external partners.

But because of that, this report provides us the opportunity to utilize our synergistic powers and instill into the findings our knowledge of the drug/therapy development and manufacturing taking place through all sorts of outsourcing arrangements today.

So here's a look at the report through our clarifying lens.

Less Funding, Still Plenty

An example of applying our faculties of sector harmonization starts with this early analysis, and a related chart:

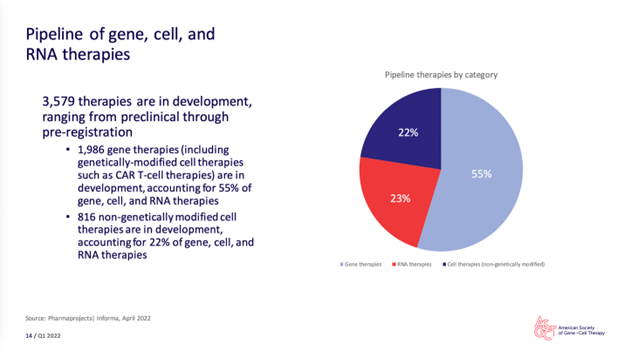

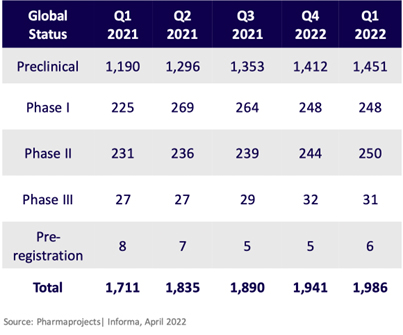

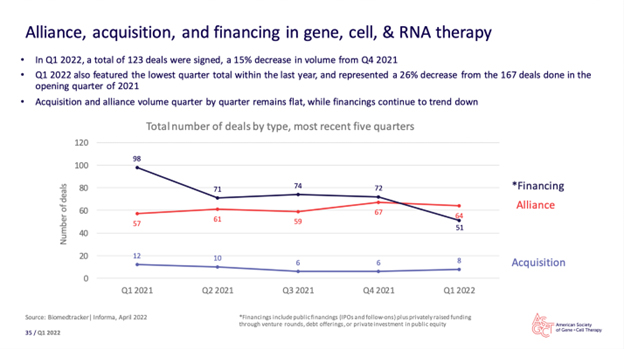

“Q1 2022 saw the lowest quarter total of deals signed within the last year, representing a 26% decrease from Q1 2021. Alliance volume remained flat and financings trended down. Start-up financing dropped to $507.8 million, while the number of companies raising seed or Series A financing stayed at 15. Overall, however, the gene, cell, and RNA therapy landscape continues to expand. The gene therapy pipeline has increased 16% since Q1 2021. In the pipeline, there are 3,579 gene, cell, and RNA therapies in development from preclinical through pre-registration stages.”

What’s our outsourcing takeaway?

Money and activity in the CGT/mRNA space may be slowing – leveling out might be a better descriptor – as macroeconomic conditions (e.g., inflation, fears of recession – and in some areas downright recessionary conditions) are beginning to have an impact.

Nonetheless, when the report sums up the “pipeline” and informs us of over 3,500 therapies in development, it lays bare the momentous amount of concentrated activity underway and to come – and, I’m sure, sets many CRO and CDMO hearts aflutter.

And again raises a question: Can our development and processing outsourcing industry keep up?

The answer I’ve been hearing from industry executives and reporting to you seems to be a highly qualified, “Yes.” (In fact, we just held a webinar tackling this very subject that I highly recommend to all readers.)

So why the iffy affirmation? Because development realities take place. The oftentimes sad but necessary culling in development stages kicks in, and the report provides us an excellent graphic of that.

Outsourced Pharma has been able to glean from numerous interviews, webinars, and other industry reporting (including at our own ISR Reports), that if there were major challenges of outsourcing capacity and finding equipped CDMOs in the past (and there were), for the most part (although the “COVID years” didn’t help), we have or are working our way through those.

The above two charts also represent, depending on your point of view, an excess of dollars chasing programs that might not have been so readily progressed.

Funding, though, makes the overall biotech world go round, and on its own is a key metric to anyone involved in outsourcing. But also through these statistics, drug developers can identify the conundrum your CDMOs face.

Should they bulk up – build out and invest in more dedicated space and/or facilities; purchase more equipment and hire more staff (scientists, engineers, project management, BD); and should they turn a more-rounded service offering to a specific focus on CGT/ mRNA? Or scale back, and keep a broad clientele?

These questions are amplified when sponsors are indicating external partners don’t have the requisite (or the right-sized) capacity or resources to start work on development projects today – but CDMOs fear an economic slowdown on the horizon.

Harder Than Rocket Science?

The above dialogue highlights just what a miraculously difficult industry we are in. So many of your research/pre-clinical programs will not make it. Yet, CROs and CDMOs need to plan for (and have some insight into) how much work may actually grace their doors in the aggregate, and which components of that work will prove the most successful for them (the sponsor, and patients).

Regarding the final part of that statement, we won’t go into specific therapies or pursuits in this analysis, but the report does a great job of summarizing where the most interest lies. (Hint: CAR-T still going strong.)

But I want to get back to the business of outsourcing. Here’s the last chart from the report I’d like to present to readers.

Thankfully, this chart’s one-year view demonstrates a relatively benign change through some difficult recent times. Hopefully, quarter-by-quarter, year-over-year, we can maintain an outsourcing equilibrium that brings the best drugs and therapies to patients.

But the caution here is that there are “life cycles” to every industry and enterprise, and they interact with macroeconomic cycles as well. (We started reporting on this via an in-depth series that started with this editorial.)

Few business pursuits are not impacted by inflation, supply-chain disruptions (of all varieties), raw-material shortages, country-specific or global economic downturns, or the opposite of all that: economic bubbles, including over-financing, too much capacity coming online … or some form of the Holland Tulip Mania

In the ATMP space, CROs and CDMOs will continue to play a critical role in getting Outsourced Pharma readers through whatever may come.

Even if we don't speak their names.